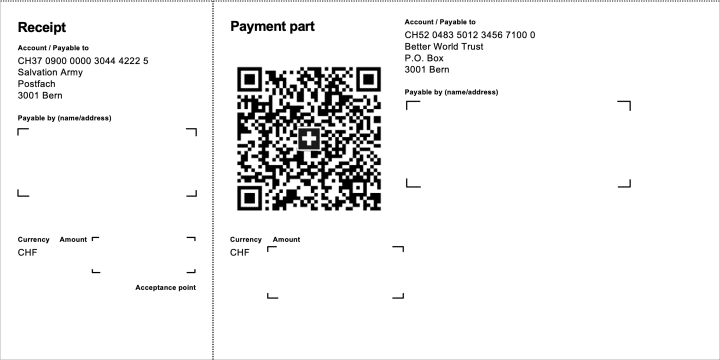

QR invoices contain all relevant payment information inside a QR code, can be printed or issued digitally and consist of a receipt and a payment section.

The most important points to remember:

- The QR code at the centre of the QR invoice payment section contains all relevant payment information also displayed on the invoice in text format.

- The option to scan the QR code makes for fast invoice entry and processing.

- Once the QR code has been scanned, you should compare the data recorded with the correct payment information (IBAN, recipient, amount etc.) stated on the invoice.

- It has now become easier for both the invoicing party to draw up an invoice and the consumer to pay, and sources of error are also reduced.

QR invoices in a nutshell

QR invoices are divided into two parts – a receipt and a payment section. The QR code in the centre of the payment section can be read by a QR reader, a webcam or a smartphone. The code contains all information required to pay an invoice. Additional information can also be integrated into a QR code to facilitate processing by account departments.

In addition to e-banking, you can also process an invoice by separating both receipt and payment section from the invoice along the perforated line, to then pay at a post office or send a payment order to your bank by mail.

Source: SIX website

This matrix consisting of black and white squares (QR code) can be read by a QR reader, a PC camera or a smartphone. The code contains all information required to pay an invoice. Additional information can also be integrated into a QR code to facilitate processing by account departments.

In addition to this QR code, new invoices also contain all important (previous) payment information in plain text.

What should you look out for to stay secure?

Once a QR code has been scanned in, the data recorded will have to be compared to the correct payment information (IBAN, recipient, amount, etc.) stated on the invoice in plain text. If these details don’t agree, you must stop your payment immediately!

It is important to check this, since criminals e-mail invoices containing a QR code referring to a different account number than the one stated in plain text on such invoices.

Payment options

Using QR invoices will make it easier to pay invoices. Instead of laboriously typing in account and reference details when e-banking, QR codes already contain these details.

As a private individual, there are the following three options to pay a QR invoice:

Open your e-banking facility; scan the QR code in using a QR reader, your webcam or your smartphone and click to trigger the payment.

Source: SIX website

Create your own QR invoices

To issue an invoice, you can print out your QR invoices on white paper yourself, so there is no longer any need to order any pre-printed deposit slips from your bank anymore.

The independent www.qr-rechnung.net website enables private individuals, clubs and smaller businesses – who only issue invoices periodically and therefore wouldn’t want to use special software to do so – to create their own QR invoices in a simple manner and free of charge.

Further information can be found on the SIX website.